Organize Tax Filing with the Best Mileage Tracker App and an Accurate Mileage Log

Organize Tax Filing with the Best Mileage Tracker App and an Accurate Mileage Log

Blog Article

Optimize Your Tax Obligation Reductions With a Simple and Effective Mileage Tracker

In the world of tax deductions, tracking your gas mileage can be an often-overlooked yet critical job for optimizing your financial advantages. Comprehending the subtleties of efficient mileage monitoring might expose strategies that might significantly influence your tax scenario.

Relevance of Mileage Monitoring

Tracking gas mileage is vital for anyone seeking to maximize their tax obligation reductions. Accurate mileage monitoring not just ensures compliance with internal revenue service policies however likewise permits taxpayers to profit from reductions associated with business-related travel. For independent people and company proprietors, these reductions can dramatically decrease gross income, consequently lowering general tax obligation responsibility.

In addition, maintaining a thorough document of mileage assists identify in between individual and business-related journeys, which is crucial for validating cases during tax audits. The IRS calls for details paperwork, consisting of the day, location, purpose, and miles driven for each trip. Without careful records, taxpayers take the chance of shedding important reductions or dealing with fines.

In addition, reliable mileage tracking can highlight patterns in travel expenses, assisting in better financial preparation. By analyzing these patterns, people and services can recognize possibilities to optimize travel routes, lower costs, and boost functional performance.

Choosing the Right Mileage Tracker

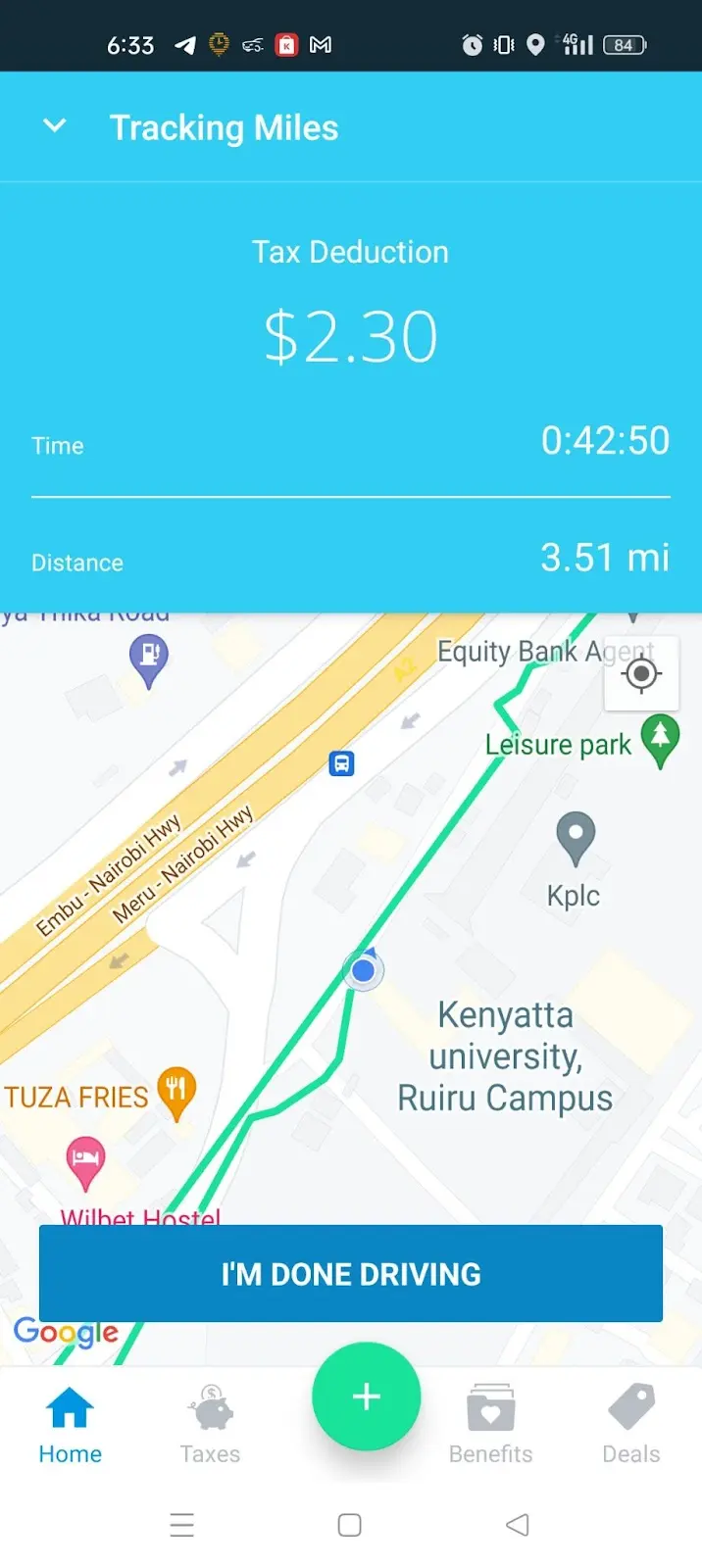

When selecting a gas mileage tracker, it is vital to think about various attributes and performances that line up with your specific needs (best mileage tracker app). The initial aspect to evaluate is the approach of tracking-- whether you favor a mobile app, a general practitioner device, or a hands-on log. Mobile applications typically provide benefit and real-time monitoring, while GPS gadgets can supply more precision in range measurements

Following, assess the combination capacities of the tracker. A good gas mileage tracker need to perfectly incorporate with accounting software program or tax preparation devices, enabling uncomplicated information transfer and reporting. Search for attributes such as automated monitoring, which minimizes the requirement for hand-operated entrances, and classification options to compare company and individual trips.

Just How to Track Your Gas Mileage

Selecting a suitable mileage tracker sets the foundation for efficient gas mileage administration. To properly track your gas mileage, start by determining the purpose of your journeys, whether they are for service, philanthropic tasks, or clinical factors. This clearness will certainly assist you categorize your trips and ensure you catch all appropriate data.

Next, consistently log your mileage. If using a mobile app, enable location solutions to instantly track your journeys. For hand-operated entrances, record the starting and ending odometer analyses, along with the day, objective, and course of each journey. This degree of information will recommended you read verify very useful throughout tax obligation period.

It's additionally vital to regularly review your entries for precision and efficiency. Establish a schedule, such as weekly or monthly, to consolidate your documents. This practice helps protect against discrepancies and ensures you do not overlook any deductible mileage.

Lastly, back up your records. Whether digital or paper-based, maintaining backups protects versus information loss and facilitates very easy access throughout tax obligation preparation. By vigilantly tracking your mileage and keeping arranged documents, you will lay the groundwork for optimizing your possible tax obligation reductions.

Making Best Use Of Deductions With Accurate Records

Accurate record-keeping is vital for maximizing your tax reductions connected to gas mileage. When you maintain comprehensive and specific documents of your business-related driving, you create a robust foundation for declaring reductions that may substantially decrease your taxed income.

Utilizing a mileage tracker can enhance this procedure, permitting you to log your journeys easily. Many apps automatically calculate distances and categorize trips, saving you time and decreasing mistakes. In addition, maintaining sustaining documents, such as invoices for relevant expenses, strengthens your case for reductions.

It's crucial to be regular in taping your mileage. Ultimately, exact and well organized gas mileage records are key to optimizing your reductions, ensuring you take full benefit of the possible tax obligation advantages readily available to you as a service motorist.

Usual Blunders to Stay Clear Of

Maintaining thorough documents is a substantial action towards maximizing mileage reductions, however it's similarly essential to be knowledgeable about usual blunders that can weaken these efforts. One prevalent mistake is falling short to record all trips properly. Also small business-related trips can add up, so overlooking to tape them can cause considerable lost deductions.

Another mistake is not differentiating between individual and service mileage. Clear classification is critical; blending these 2 can trigger audits and lead to fines. In addition, some people fail to remember to maintain sustaining papers, such as receipts for relevant expenditures, which can useful source additionally verify claims.

Using a mileage tracker app makes sure consistent and dependable documents. Acquaint yourself with the most recent laws regarding gas mileage reductions to prevent unintended errors.

Final Thought

Finally, reliable mileage tracking is crucial for taking full advantage of tax obligation reductions. Making use of a dependable mileage tracker simplifies the process of recording business-related trips, ensuring exact documents. Normal testimonials and back-ups of mileage records enhance conformity with internal revenue service guidelines while sustaining notified financial decision-making. By avoiding usual challenges and keeping careful records, taxpayers look at this now can significantly reduce their total tax obligation obligation, ultimately profiting their monetary health and wellness. Implementing these techniques promotes a positive approach to taking care of overhead.

Report this page